On the main page, choose the Template Gallery at the top.

You’ll see both the Monthly Budget and Annual Budget options in the Personal section.

Pick one and it’ll open right up for you to get started.

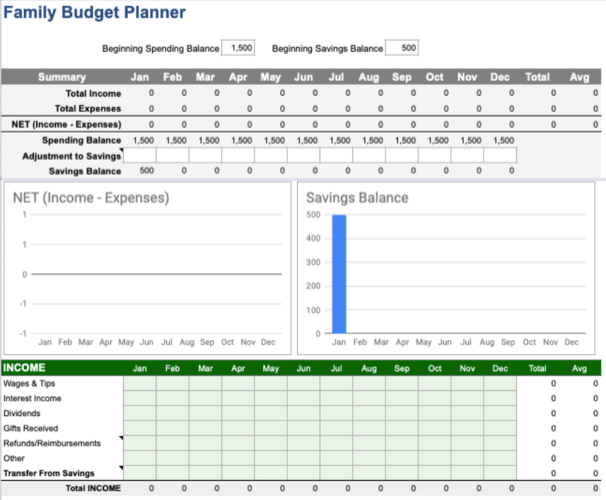

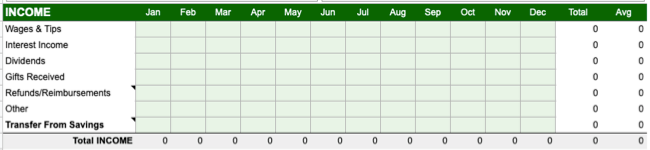

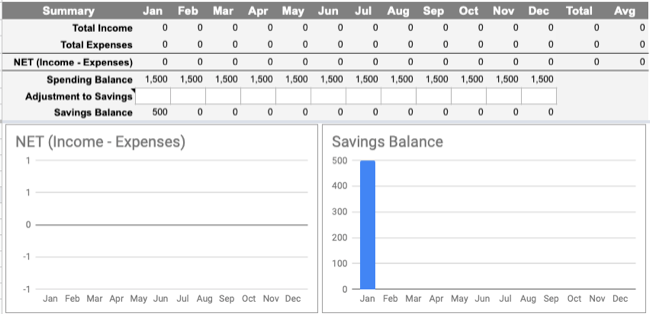

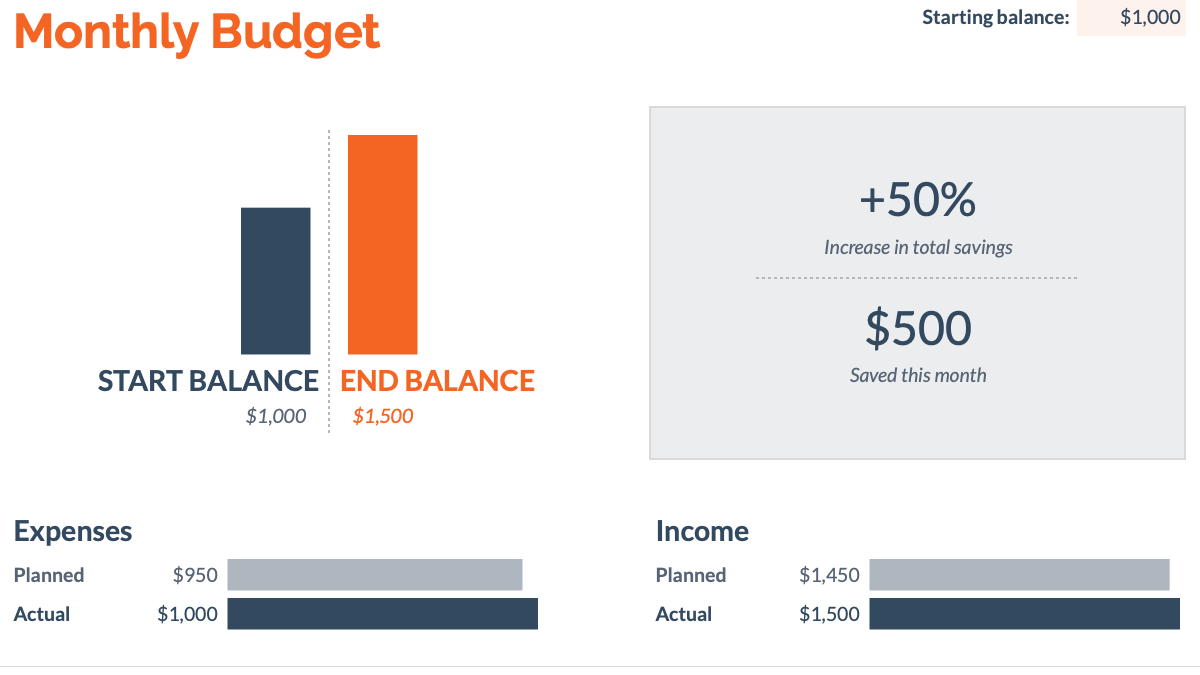

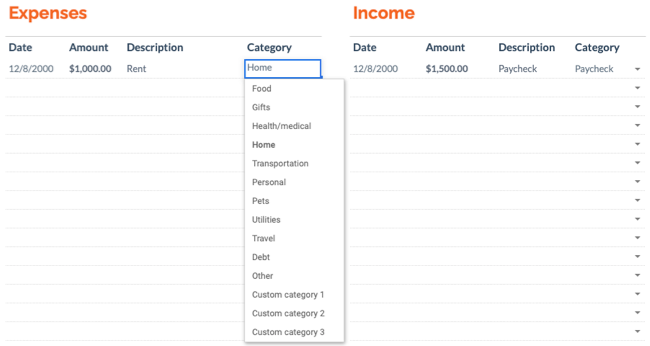

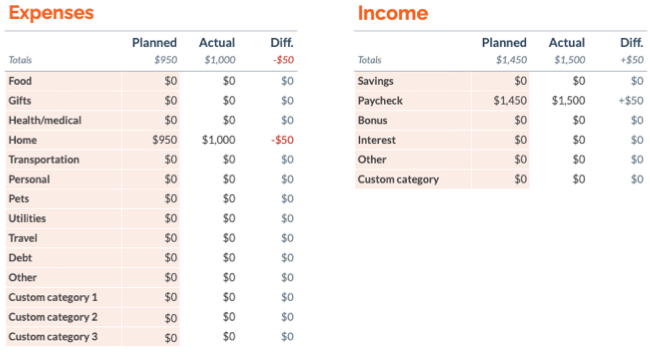

This helps the summary sheet give you an overview of where your money comes from and goes.

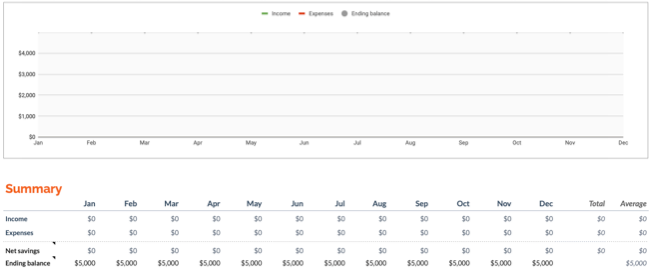

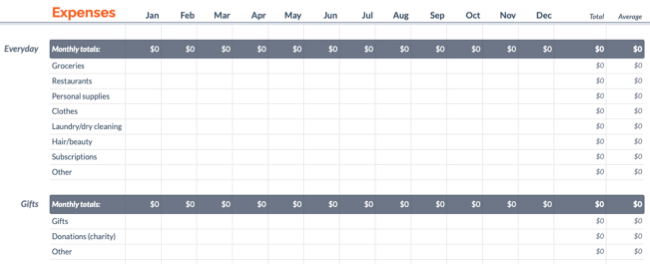

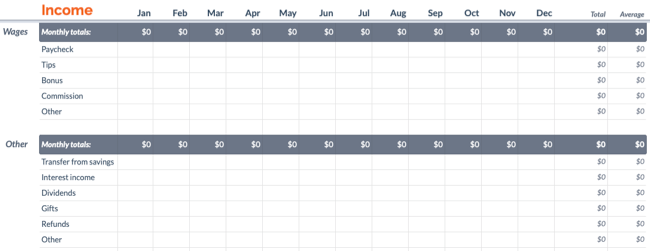

You have separate sheet tabs for income and expenses along with a summary tab to see the whole year.

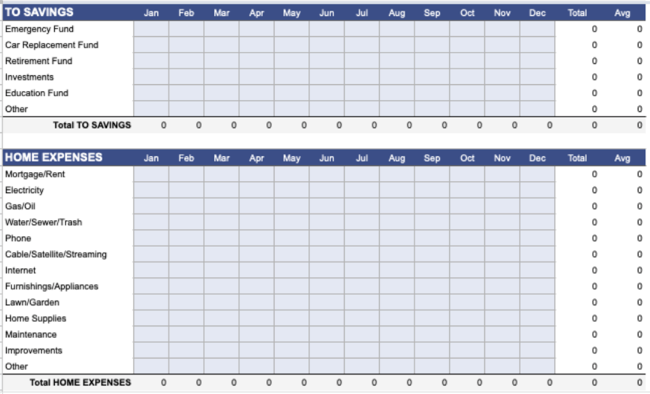

Simply enter the amounts in the categories provided for money coming in and going out.

You’ll then see an overview as the year moves on with this template.

Let’s check one out.

Continue to the expenses sections which are divided by throw in.

So you have Home Expenses, Children, Daily Living, Transportation, Health, and more.

Check out the Help tab for tips on getting started with this helpful Family Budget Planner template.

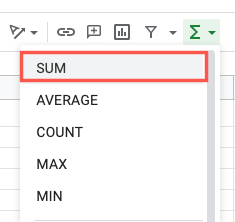

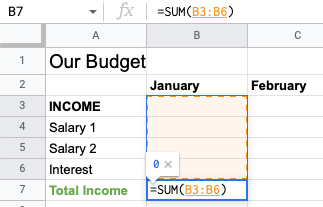

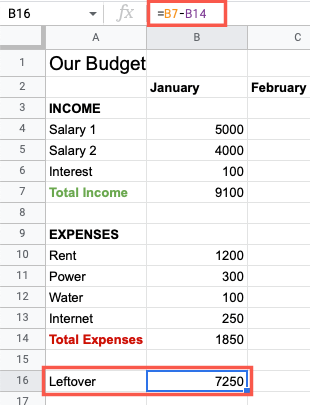

Google Sheets offers helpfulfunctions for adding income and expensesas well as subtracting amounts for money left over.

Select a Blank sheet and then give it a name.

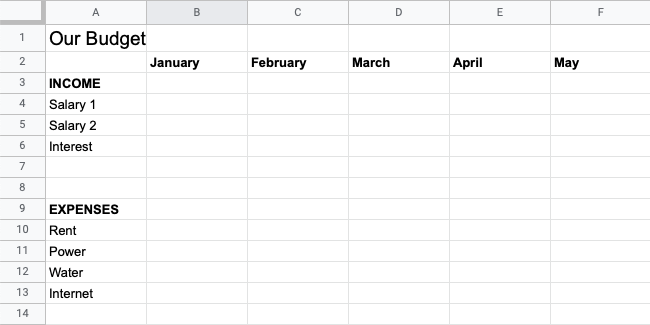

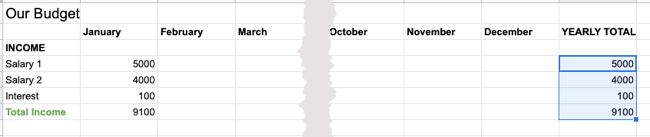

For a monthly budget, enter the months in a row at the top of the sheet.

At the bottom of each section, you canadd totals.

grab the range of cells for the total and press Enter or Return.

you could use the fill handle to drag the formula to the remaining cells on the right.

Then, do the same for the expense section.

pick the cell where you want this difference and enter thesubtraction formula.

For example, you’re free to see the total salary amount as it grows throughout the year.

Thebasic functions in Google Sheetscan help you with the calculations you need.

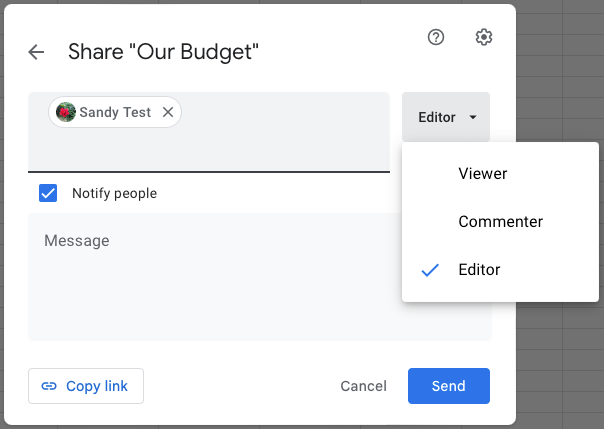

Alternatively, you could simply grant them access to see the budget if you prefer.

To the right, use the drop-down to grant permissions to the sheet for each person.

Keeping track of your budget is important to good money management.

And with Google Sheets, you might create a budget in just minutes.

For more ways to use Google Sheets, look athow to make your own calendartoo!